Explore how Florida has transformed into a haven for the super-rich.

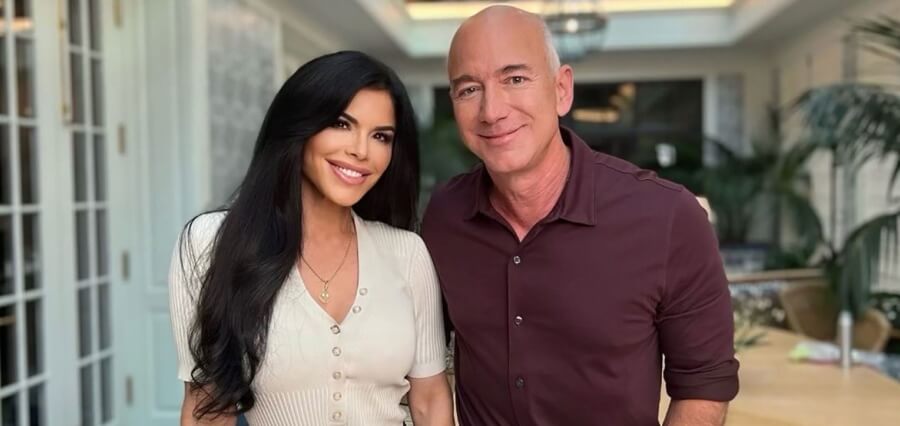

Jeff Bezos’s recent relocation from Seattle to Miami is proving advantageous. By selling $2 billion worth of Amazon shares last week, he managed to save approximately $140 million in taxes, benefiting from Florida’s tax-friendly policies for billionaires.

Given this context, it’s understandable why Bezos, one of the wealthiest individuals globally, chose to move from Washington state, where he resided for three decades and founded Amazon. While Washington lacks state income tax, it imposed a 7% capital gains tax in 2022 on sales of certain assets, including stocks or bonds exceeding $250,000. This tax generated around $890 million in revenue last year. In contrast, Florida not only lacks state income tax but also doesn’t tax capital gains.

This likely won’t be his sole sale this year. According to another Securities and Exchange Commission filing, Bezos intends to divest a total of 50 million Amazon shares before January 31, 2025, valued at approximately $8.5 billion (this initial sale comprised around 12 million shares). If everything proceeds as planned—and assuming Amazon’s stock price remains constant—he stands to save about $600 million in taxes.

Moreover, Bezos’s relocation to Florida will also result in significant savings because the state lacks an estate tax, as noted by John Pantekidis, managing partner and general counsel at TwinFocus, which oversees over $7 billion for ultrahigh-net-worth (UHNW) families. These combined benefits make the sunshine state an increasingly appealing destination for high-net-worth and UHNW families seeking to establish residency.

Read More: https://thecioleaders.com/