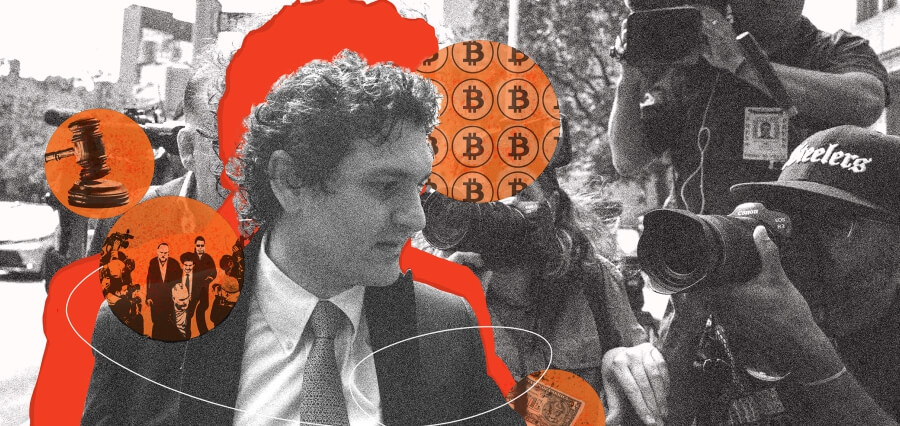

The trial of FTX founder Sam Bankman-Fried is unfolding with its first witness, Marc-Antoine Julliard, a commodities broker who diversified into cryptocurrency trading on FTX. Julliard recounted his experience with FTX, expressing trust due to the platform’s strong marketing and celebrity endorsements. However, he and thousands of other customers faced substantial losses when FTX collapsed. Bankman-Fried is facing seven federal charges, including wire fraud, securities fraud, and money laundering, with potential life imprisonment.

The prosecution aims to prove that clients believed their money stored with FTX was secure, emphasizing the marketing tactics and celebrity associations that lured investors. The defense, led by Mark Cohen, contends that clients must take responsibility for their choices in buying and trading crypto. Cohen denies Bankman-Fried’s involvement in fraud, calling it a “hindsight case” brought by the government.

The trial is expected to last six weeks, shedding light on the alleged misuse of billions of dollars in client funds, contributing to a $10 billion fraud. The prosecution’s opening statement highlighted Bankman-Fried’s alleged lies to users, investors, and lenders, emphasizing the impact on everyday investors who trusted FTX. The defense argues against portraying Bankman-Fried as a villain and provides alternative explanations for his actions, including the absence of risk management measures.

The trial unfolds against the backdrop of broader discussions about the regulation and oversight of cryptocurrency exchanges, emphasizing the need for investor protection and market integrity. The prosecution plans to present witnesses, including Bankman-Fried’s ex-girlfriend and Alameda’s ex-CEO, Caroline Ellison, who pleaded guilty and has been cooperating with authorities. The trial will continue to explore the alleged cover-up tactics, such as backdating contracts and encrypted messaging apps.

As the case unfolds, it underscores the challenges and legal scrutiny facing the cryptocurrency industry and its key figures. The outcome of the trial may have implications for the regulatory landscape and investor confidence in the crypto space.

Read More: https://thecioleaders.com/