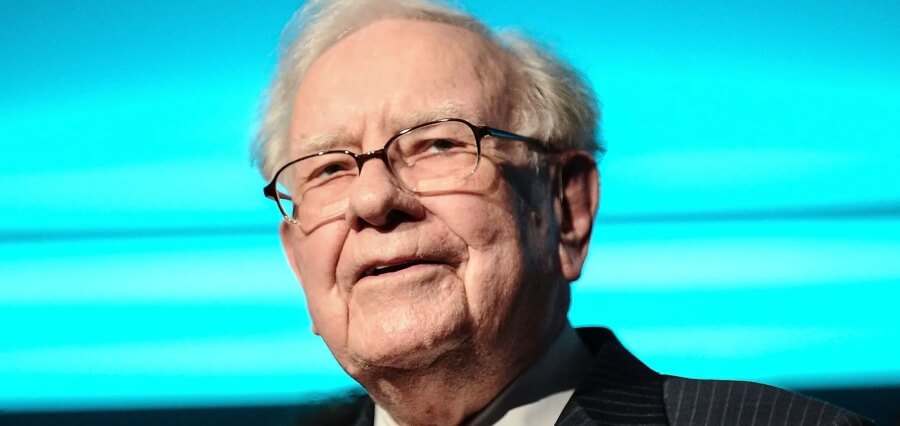

The United States lost its triple-A credit rating from Fitch Ratings, but billionaire investor Warren Buffett isn’t quivering.

The Oracle of Omaha stated in an interview on Thursday that there are some topics about which individuals shouldn’t worry. It’s “this one.”

Business at his company, Berkshire Hathaway, has not changed as a result.

“Last Monday, Berkshire purchased $10 billion worth of US Treasury bonds. On Monday, we purchased $10 billion in Treasurys. The only remaining decision for next Monday, he said, is whether to purchase $10 billion in “3-month or 6-month” T-bills.

Fitch announced on Tuesday that it was downgrading America’s long-term foreign currency issuer default rating, which was previously rated at AAA, to AA+. It criticised the nation’s mounting debt and Congress’ failure to address it.

Treasury Secretary Janet Yellen and the White House reacted angrily to the decision right away, citing numerous economic advancements and initiatives to cut back on deficit spending.

In light of the economic strength we observe in the United States, she added Wednesday afternoon, “Fitch’s decision is puzzling.” Despite the deadlock, both parties worked together to produce legislation that raised the debt ceiling and made unprecedented investments in infrastructure and the competitiveness of the United States.

On Thursday, Buffett added, “The dollar is the reserve currency of the world, and everybody knows it.” to the argument.

Canada being triple-A and not America is kind of crazy, according to Jaime Dimon, CEO of JP Morgan Chase. The United States is “still the most prosperous and secure nation on the planet,” according to some.